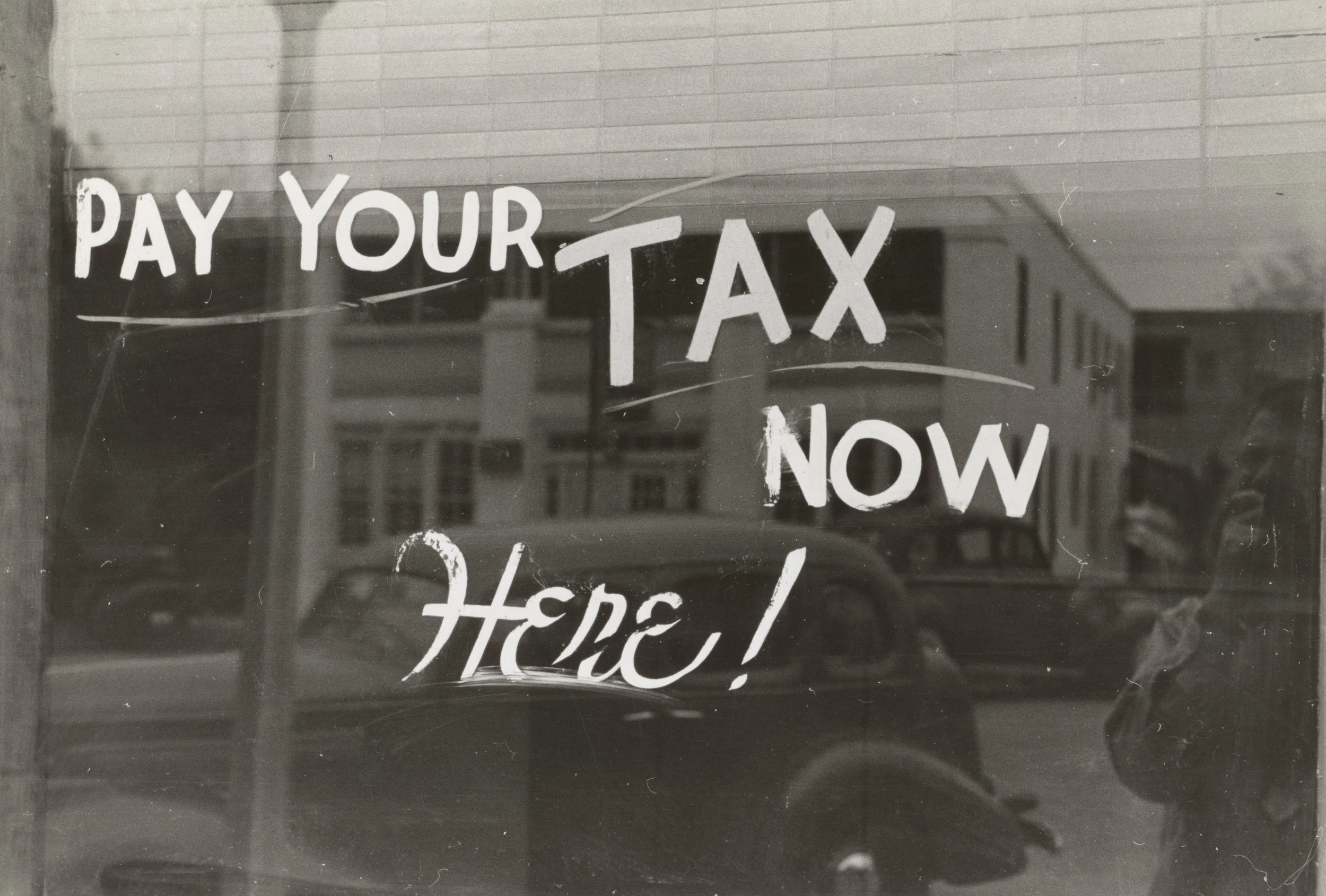

Proposed Property Tax Hikes to Have Severe Impact on Nashville’s Small Business Community

Since his election in September of 2019, Mayor John Cooper has been threatening a raise in taxes in an attempt to pull Nashville out of its fiscal downward spiral.

This week, that raise in Nashville’s property taxes became a reality.

With his recommended 2021 budget, Mayor Cooper has proposed a near 32% increase in property taxes.

Now - it’s important to note that Nashville will still have the lowest property tax rate of all of the major cities in Tennessee and hasn’t had an increase in property taxes since 2012.

We’re not here to argue that the property tax raise should or shouldn’t happen - we’re here to discuss the timing and devastation this increase will have on small business owners right now.

We’ve just been hit by a tornado. We’ve been shut down by COVID-19. Why does this increase have to happen now?

What Your Property Taxes Are Intended to Cover

Property taxes are levied upon real estate owners in order to cover services provided by local governments.

For most municipalities, these services include:

Public Parks and Facilities

Public Safety

Sanitation and Trash Services

School Systems

Streets and Thoroughfares

Why It’s Devastating for Nashville’s Small Businesses

For most small businesses, this tax raise will significantly increase their rents.

But why?

If business owners are simply leasing the commercial real estate and don’t own the property, they shouldn’t be worried about property taxes.

Unfortunately for the small business community, that’s just not true.

Most leases are structured on a triple net (NNN) or modified gross (MG) basis. And while we won’t dive into the overwhelming details of commercial real estate leases, both of these lease structures either pass on total or partial responsibility for taxes to the tenants.

That means that any increase in property taxes passes right by the ownership of the property and is billed to the small business owners.

Not only will these businesses be seeing an increase in expenses at a time where it’s already costly to open, operate, and sustain a small business in Nashville, but we’re in the wake of a crippling tornado and shut down by Coronavirus.

There are many small businesses in Nashville that simply won’t survive this hike.

Where is the money from property taxes actually going?

Nashville seems to have an issue with properly allocating its tax dollars.

In 2018, Alex Apple of Fox News 17 and I discussed why Nashville was short on money if it had more tax payers than ever before. After all, we’ve been in the largest economic upswing that Nashville has ever seen - we should be thriving.

The question “Where is the money going?” has been asked for years, but we can’t seem to either figure that out or force a change in our city policies.

Anecdotally, you’ll also hear locals complaining about the school systems, public safety, and streets (no, not 440, that’s on the State) all the time. “They’re underfunded and understaffed,” we’ll often hear - but how?

Where is the money going?

Property Taxes Have Already Increased

Property taxes in recent years, in fact, have increased.

While the city hasn’t increased the tax rate since 2012, property values have been reassessed. With Nashville’s unprecedented economic gains over the last decade, those properties have significantly increased in value and, therefore, the amount paid in property taxes.

In fact, in a post to his business’ Facebook page, Peg Leg Porker owner Carey Bringle states that his property taxes have increased 1100% since he bought the building in 2013. This tax rate increase would bring that increase up to 1600% in less than 8 years.

Why We Need to Help the Small Business Community (And How to Do It)

Small businesses are the backbone of Nashville’s community, economy, and soul.

If we don’t fight to protect the businesses that have made Nashville the “It” city, we will lose them and we will fall right back down the mountain that we’ve fought so hard to climb.

These small businesses are a part of our community’s identity - they are an integral part of what shapes us and our daily lives.

I don’t know about you, but I certainly don’t want to live in a Nashville without Peg Leg Porker and the countless other small businesses just like it that have made our city great.

Here’s How You Can Help

Email or call your local councilperson. Many of them are also highly active on Twitter.

And be kind to them. They work tirelessly to fight for their constituents and their constituents’ needs, an often-thankless job.

Let them all know that you do not support these tax rate increases and that we need to work together to find other ways to solve our city’s fiscal issues without punishing small businesses.

Share This Article:

About The Author:

Tyler Cauble, Founder & President of The Cauble Group, is a commercial real estate broker and investor based in East Nashville. He’s the best selling author of Open for Business: The Insider’s Guide to Leasing Commercial Real Estate and has focused his career on serving commercial real estate investors as a board member for the Real Estate Investors of Nashville. Learn more at www.TylerCauble.com

Zoning is one of the most overlooked—but absolutely critical—factors in commercial real estate investing. Before you ever run your cap rate calculations or start negotiating terms, zoning determines what you can and cannot do with a property. It shapes everything from who you can lease to, to what kind of tenants you can attract, to whether your business plan even works at all.

A flex space that’s zoned industrial may allow you to lease to a logistics operator or a manufacturing tenant—but that same building in a commercial zone could restrict your options to retail or office users. And if you buy a building that’s out of compliance with current zoning regulations? You could be facing expensive legal battles, permit issues, or a complete stall in your investment timeline.

In this blog, we’ll break down the zoning essentials every CRE investor should understand before buying a property. From use categories and zoning overlays to variances and value-add plays, this guide will help you ask the right questions and avoid costly mistakes. Whether you're buying your first small warehouse or adding to a portfolio of mixed-use developments, zoning can either be your greatest advantage—or your biggest risk.