Commercial real estate is a cornerstone of the business world, offering opportunities for investors to secure their financial future.

One of the most critical decisions you'll make as a business owner is whether to own or rent your property.

Let’s break down the pros and cons of each option and show you how to determine which direction you should take (and when!).

Key Takeaways:

Here’s what you’ll learn in this article:

Ownership Advantages: Building equity, control and flexibility, potential appreciation, and stronger tax benefits.

Ownership Disadvantages: High capital requirements, management responsibilities, and exposure to market risks.

Rental Advantages: Lower initial costs, flexibility, and reduced management responsibilities.

Rental Disadvantages: No equity accumulation, potential rent escalation, limited control, and fewer tax benefits.

When and how: At what point in your business does it make sense to utilize either option?

Pros and cons of Owning Commercial Property for your business

Whether a company should own its own property depends on various factors, including the company's specific circumstances, goals, and financial resources. Here are some key considerations to help make this decision:

Advantages

Equity Building: Owning a commercial property provides the opportunity to build equity over time. As you diligently pay down your mortgage, your ownership stake in the property steadily increases, allowing your business to help you build wealth personally. You can actually “house hack” commercial real estate this way.

Control and Flexibility: Ownership grants you substantial control over your destiny, giving you the ability to tailor the space precisely to your business needs and preventing an unwanted relocation since you can decide when and if you want to leave that location. Additionally, you can explore income-generating opportunities by leasing unused or surplus space within the property.

Potential Appreciation: Commercial properties have the potential to appreciate in value over time - historically at 3% to 5% per year. This appreciation can serve as a valuable long-term asset and further enhance the overall return on your investment.

Tax Benefits: One of the key perks of ownership is the array of tax advantages commercial real estate offers. This includes deductions for mortgage interest payments, property depreciation, and even various operating expenses - all of which can significantly reduce your overall tax liability.

Disadvantages

Capital Requirements: Purchasing commercial real estate typically necessitates a substantial upfront financial commitment. This requirement can be a significant hurdle, particularly for individuals or businesses with limited capital resources.

Management Responsibility: As an owner, you assume the full responsibility of property management. This includes overseeing maintenance, handling tenant relationships, and administering lease agreements. The hands-on nature of these tasks can be time-consuming and potentially demanding.

Risk Exposure: Ownership carries inherent risks. Market fluctuations, economic downturns, and potential vacancies can impact your cash flow and profitability. It's essential to have a robust risk management strategy in place to mitigate these potential challenges and safeguard your investment.

2. Pros and Cons of Renting commercial Property for your business

As with nearly everything in business, whether a company should rent its property also depends on several factors, and there is no universal answer.

Here are the key considerations to help you determine if renting commercial property is the right choice for a company:

Advantages

Lower Initial Costs: Renting demands significantly lower upfront capital, making it a more accessible option, especially for businesses with limited financial resources. This can free up capital for other business investments and operations or grant you the ability to open several locations faster.

Flexibility: Leasing provides a high degree of flexibility. It allows your business to adapt to changing needs and market conditions without the commitment of property ownership. This flexibility extends to the ability to relocate or expand more easily, which can be vital for businesses in dynamic industries.

Limited Responsibility: Renters typically enjoy a reduced operational burden, as property maintenance and management responsibilities predominantly fall on the landlord. This can translate into time and cost savings for your business. If nothing else, it’s less of a headache to deal with on a daily basis.

Disadvantages

No Equity Accumulation: Perhaps the most significant drawback of renting is that it does not contribute to building equity or ownership in the property. Unlike property owners, whose mortgage payments build ownership equity over time, renters essentially pay for the right to use the property without accumulating any ownership stake.

Rent Escalation: Rents tend to increase over time, often linked to inflation or market conditions. This can impact your long-term financial planning and potentially erode profitability as rental costs rise.

Limited Control: Tenants have limited control over property modifications during their build-out and lease terms. Significant alterations or customization may require landlord approval, limiting your ability to shape the space precisely to your needs.

No Tax Benefits: Unlike property owners who enjoy various tax deductions, renters do not benefit from these tax advantages. Rent payments can be written off against your revenues since they are an operational expense of the building and any improvements you make to the space can be depreciated, but that’s nearly the extent of the benefits.

3. Financial Comparison between Owning vs Renting

The financial difference between owning and renting a commercial property can be significant and, again, both have their pros and cons.

Below, I'll outline some key financial considerations you should keep in mind:

Initial Investment:

When weighing the decision between owning and renting commercial property, the upfront financial commitment is a pivotal factor. Owning typically demands a substantial initial investment that includes the property's purchase price or your down payment, closing costs, and any renovation costs.

These numbers can often end up in the 20% to 30% range of the total purchase price of the property. For example, if you’re buying a $1,000,000 property and spending $250,000 in renovations for a total of $1,250,000, you’re likely going to be out of pocket between $250,000 to $375,000.

In contrast, renting generally requires a much lower initial capital outlay, often the first month’s rent, security deposit, and renovation costs, making it a more accessible option for businesses with constrained resources.

Cash Flow Analysis:

To make an informed choice, you’ll want to conduct a comprehensive cash flow analysis. When you own a property, you need to consider not only the mortgage payments but also ongoing maintenance costs, property taxes, insurance, and any vacancy-related income loss.

On the other hand, renting involves monthly rent payments, which may increase over time due to lease escalations. By comparing these cash flows, you can evaluate which option aligns better with your business's financial objectives and sustainability.

Learn more about common property expenses that you should keep in mind.

Long-Term Wealth Building:

Another vital aspect to consider is the long-term wealth-building potential of your decision. Ownership offers the opportunity to accumulate equity as you pay down your mortgage. Additionally, commercial properties have the potential to appreciate in value over time, which can significantly boost your overall wealth.

On the contrary, renting does not contribute to equity accumulation or property appreciation, as rent payments essentially cover the cost of using the space. But, you could potentially see higher cash flow from the business, so you’ll want to perform a cost / benefit analysis between the two.

When deciding between owning and renting, it's essential to weigh these factors carefully and consider your long-term financial goals.

4. Market Conditions and Timing

The economic landscape can significantly shape your property choices and their potential outcomes. You’ll need to evaluate rental rates, property values, and financing options, all of which can sway your property decisions in different economic climates.

Economic Factors:

Consider the following economic factors:

Rental Rates: Analyze whether the current rental rates align with your budget and long-term financial goals. Economic upswings often lead to higher rents, while downturns can result in more favorable lease terms. You’ve heard the term “landlord’s market” or “tenant’s market” and there will be times when it may make more sense to rent simply because the costs are far lower than owning.

Property Values: Assess the effect of economic trends on property values. In robust economies, property values tend to appreciate, potentially increasing your property's worth over time. Conversely, economic downturns can lead to stagnation or even depreciation. Economic downturns are often the best times to buy commercial properties because you can get a better deal on the purchase price.

Financing Options: Economic conditions also influence financing options. Favorable economic climates may lead to lower interest rates, making property ownership more attractive. Conversely, economic instability can result in tighter lending conditions and higher borrowing costs. 1% or 2% increases in interest rates can significantly sway your monthly payments, so be sure to take that into account when looking at monthly expenses.

Real Estate Market Cycles:

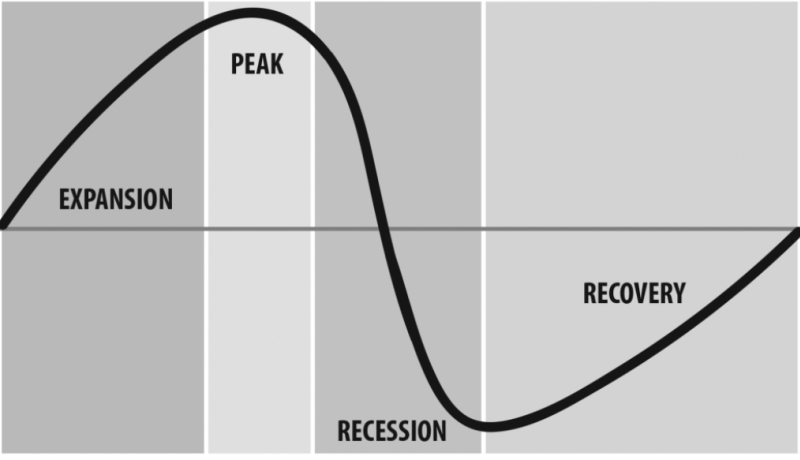

Real estate markets typically go through cycles with phases of expansion, peak, contraction, and recovery. Consider the following phases:

Expansion: During this phase, property values tend to rise, and demand for rental space increases. Investing during expansion can offer opportunities for potential appreciation and income growth.

Peak: The peak signifies the market's zenith, where property values may stabilize or even plateau. Rental rates may be at their highest, but competition for desirable properties can be intense.

Contraction: In this phase, property values may decline, and rental demand may decrease. However, this phase can present opportunities for value investors, as prices may become more favorable.

Recovery: The recovery phase follows a contraction and indicates the market's rebound. Property values and rental demand begin to rise again, making it a potentially strategic time to invest.

5. Decision-Making Factors

Deciding whether to own or rent a commercial property for your business is a critical decision that should be carefully evaluated. Here are the key steps and considerations to help you make an informed choice:

Business Objectives:

When deciding between owning and renting commercial property, it's imperative to align your choice with your business objectives. Consider factors such as:

Business Goals: How does owning or renting a property contribute to your business's long-term goals? For some, ownership may align with stability and long-term growth, while others may prioritize flexibility.

Growth Plans: Assess your business's growth trajectory. If expansion is on the horizon, consider how each option supports scalability and evolving space needs.

Risk Tolerance: Evaluate your willingness to embrace risk. Ownership carries inherent risks, while renting can provide a level of stability. Choose the option that best aligns with your risk tolerance.

Financial Resources:

Your financial capacity plays a pivotal role in this decision-making process. Thoroughly assess your resources and consider:

Capital Availability: Determine if you have the necessary capital for a down payment and ongoing ownership costs if you opt to buy. For renting, assess your budget for lease payments and potential rent increases.

Cash Flow: Examine your business's cash flow to ensure you can comfortably manage ownership expenses or monthly rent payments without compromising your operational viability.

Return on Investment: Calculate the potential return on investment for each option to gauge the financial impact on your business over time.

Risk Tolerance:

The level of risk you're willing to undertake should not be underestimated. Consider the following when assessing your risk tolerance:

Market Volatility: Ownership exposes you to market fluctuations that can affect property value and rental income. Determine how comfortable you are with these potential swings.

Property Management: Evaluate your willingness and capability to handle property management responsibilities if you choose ownership. Managing a property can be demanding and requires expertise in various aspects of real estate.

Lease Obligations: If you opt to rent, carefully review lease terms and obligations to ensure they align with your risk tolerance and business objectives.

Deciding whether to own or rent a commercial property for your business requires a thorough assessment of financial resources, long-term goals, risk tolerance, and market conditions.

Carefully weigh the advantages and disadvantages of each option and seek professional guidance to make an informed choice that aligns with your company's unique needs and vision. Remember that there is no one-size-fits-all answer, and the decision should align with your specific circumstances and objectives.

Seek Professional Advice:

Commercial real estate investing can be complex, and the stakes are high. To navigate this terrain successfully, it's prudent to seek guidance from experts.

Consult with experienced real estate professionals, financial advisors, and legal counsel who can provide valuable insights, help you identify opportunities, and mitigate risks. Their expertise will be invaluable in making a sound decision that sets your business on the path to commercial property success.

FAQ’S

Why would a company lease a building rather than buy?

Leasing a building can be a preferred choice for companies looking to preserve capital, maintain flexibility in the face of changing space needs, and avoid the significant upfront costs associated with property ownership. It's also advantageous when a business values location adaptability or prefers to delegate property management responsibilities to a landlord.

What is an advantage of buying a building rather than leasing it?

One significant advantage of buying a building is the potential for long-term wealth building. Property ownership allows a company to build equity over time, benefit from potential property appreciation, and enjoy tax advantages like mortgage interest deductions. It also provides greater control over property modifications and the potential for rental income from unused space.

What advantage do lease decisions have over purchase decisions?

Lease decisions offer advantages such as lower initial costs, predictable monthly expenses, and the ability to adapt to changing space requirements with relative ease. Leasing can be an ideal choice for businesses seeking financial flexibility and those focused on core operations rather than property management.

What are the cons of leasing to own?

While lease-to-own arrangements can offer a path to property ownership, they may come with some downsides. These may include higher overall costs compared to traditional financing, limited control during the lease period, and potential complexities in negotiating purchase terms and prices.

Does leasing hurt your credit?

Generally, leasing a commercial property does not directly impact a company's credit negatively. However, late or missed lease payments can affect credit scores if reported to credit bureaus. It's essential to honor lease agreements to maintain a positive credit history and reputation with landlords and creditors.

Zoning is one of the most overlooked—but absolutely critical—factors in commercial real estate investing. Before you ever run your cap rate calculations or start negotiating terms, zoning determines what you can and cannot do with a property. It shapes everything from who you can lease to, to what kind of tenants you can attract, to whether your business plan even works at all.

A flex space that’s zoned industrial may allow you to lease to a logistics operator or a manufacturing tenant—but that same building in a commercial zone could restrict your options to retail or office users. And if you buy a building that’s out of compliance with current zoning regulations? You could be facing expensive legal battles, permit issues, or a complete stall in your investment timeline.

In this blog, we’ll break down the zoning essentials every CRE investor should understand before buying a property. From use categories and zoning overlays to variances and value-add plays, this guide will help you ask the right questions and avoid costly mistakes. Whether you're buying your first small warehouse or adding to a portfolio of mixed-use developments, zoning can either be your greatest advantage—or your biggest risk.