What is Cost Segregation?

One of the many reasons commercial real estate is so profitable is the ability to take advantage of depreciation.

As buildings wear out over time, the IRS allows owners of investment properties to deduct a certain amount from their income every year before tax is applied as “depreciation expense”. Since this is an imaginary or paper expense, in that you’re not paying for it out of pocket, the more you claim in depreciation the more you can walk away with after taxes.

Cost segregation is a common way of trying to maximize the amount of depreciation expense you can claim by speeding up the abstract decline in property value. Let’s take a look at how that plays out.

How Depreciation on a Commercial Property is Calculated

There are a couple different ways you can track depreciation but the simplest is to just find how long it will take the asset to completely fall apart, also known as its “useful life”, and then divide how much you paid for it by that many years.

This method is called “straight line depreciation”, as you end up claiming the same amount every year in depreciation expense. The IRS has set rules for the length of time to use for different items in these calculations, with single and multifamily rentals being expected to last 27.5 years and commercial properties expected to last 39 years.

Don’t be too quick to just take the sale price and divide it by 39 years, though.

Normally when you buy a property, you purchase both the building and the land it sits on, and, while the building can be depreciated, the IRS has stated that land can’t be. So, you’ll have to split that purchase price into two components - one you claim you paid for the land and the other you claim you paid for the building. Once you have a number for the value of the building, you can now divide that by 39 years to come up with your annual depreciation expense.

How Cost Segregation Works

The term “cost segregation” sounds complex, but the good news is that it works the exact same way. Since the IRS has different timelines for how long different things will last, it is often beneficial to take the portion of the sale price you paid for the building and split it up even further.

In our price divided by lifetime equation, as the total lifetime an item is expensed over decreases, the annual depreciation expense goes up. So, by redefining which IRS category something falls into, you can potentially claim it has a shorter lifetime and speed up the amount you expense in the early years of ownership. Hence the more common name, “accelerated depreciation.” And remember - since this expense is a paper loss, the higher you can make it, the more income you can keep from being taxed.

Ultimately, how quickly you can benefit from depreciation comes down to how much of your property falls into each of the IRS’s four different categories:

Personal property that you have a hand in choosing, like a bathroom fixture or carpeting, can be expensed over 5 or 7 years

Improvements to the land, such as sidewalks or fencing, can be expensed over 15 years

The building is expensed over 39 years if it is commercial (or 27.5 years if it’s residential)

The land is not expensed

The boundaries and definitions on where things fit can be rather vague, making it absolutely critical that you hire experienced professionals to conduct a “cost segregation study” on your property rather than trying to figure it out yourself. Usually the ones conducting the study will have a team made up of accountants, lawyers, and engineers, who work together to decide which things should go into each category.

Example of Cost Segregation

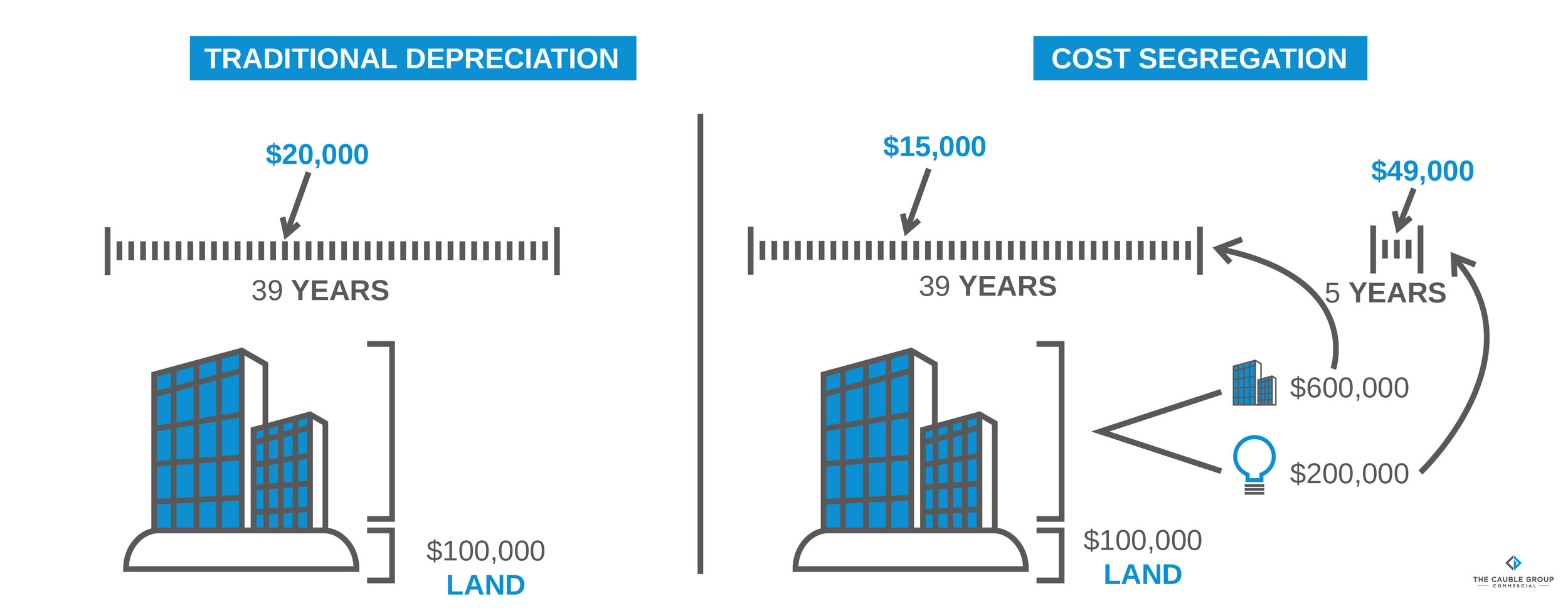

Cost segregation can be a very powerful tool for real estate investors, so let’s look at an example. Rachel invests in an office building that she plans to sell in 5 years, and pays $900,000 altogether to the seller. She talks with her accountant, and they decide that the land value was worth $100,000. Rachel divides the remaining $800,000 over 39 years to come up with a rough depreciation expense of $20,000/year. This means when she sells in 5 years, the total value she will have kept from paying taxes on is around $100,000.

Rachel really wants to increase her depreciation expense so she doesn’t have to pay as much in taxes, so she reaches out to a local firm that she heard does cost segregation studies. After completing their analysis, they tell her that she can claim that a quarter of the $800,000 was used to pay for the interior fixtures and finishes. As “personal property”, this can be depreciated over 5 years instead of 39.

Rachel now does the math to see how much that will change her total depreciation expense over the 5 years before she sells. With this new information, she divides the first $200,000 over 5 years and the other $600,000 over 39 years. She comes up with $40,000/year for the interior fixtures and finishes and roughly $15,000/year for the building, for a total of $55,000/year in depreciation expense the first 5 years the property is owned. She can now shield $275,000 from taxes - a sharp increase!

This example is exaggerated, but it demonstrates the core concepts of cost segregation: split the property value into different IRS categories, assign each the right timeline, and benefit from the accelerated expense schedule.

Who should Cost Segregate?

Cost segregation studies typically occur as a property is being purchased or directly after, to give the buyer the correct information for their financial records from the start. After this point, the process of keeping things organized is relatively simple as things are worn out and replaced.

In the above example you may have noticed that the only thing that changed was the timing, as either way the full amount of depreciation expense would have been the same at the end of 39 years. However, even if you are holding a property for more than 39 years cost segregation can still provide value by freeing up those tax savings sooner and giving you the opportunity to invest in other projects.

The major limiting factor, however, is pricing. A general recommendation is to look into getting one for property acquisitions that cost more than $750,000, but cost segregation studies do tend to be expensive and are charged on a flat fee basis. As with most things in commercial real estate, it really comes down to each individual property owner’s unique circumstances and financial situation, so it’s best for any commercial real estate investor to consult a CPA or cost segregation specialist for their investment properties.

![What Is Cost Segregation? [And How It Works!]](https://images.squarespace-cdn.com/content/v1/5c115fec9d5abbba78a23c93/1618865932824-DS9FXIQZS0JLT7HP18RM/calculator-calculation-insurance-finance-53621.jpeg)

Recessions expose the strengths and weaknesses of every investment portfolio—but in commercial real estate, some asset classes consistently rise above the volatility. While economic downturns often lead to higher vacancies, tighter lending conditions, and declining property values, not all sectors are equally vulnerable. In fact, a select group of asset classes tend to outperform, offering dependable cash flow and tenant stability even in uncertain times.

These recession-resistant properties share a few key traits: they serve essential needs, attract long-term tenants, and demonstrate historically low vacancy rates regardless of economic conditions. Whether you’re a seasoned investor rebalancing your portfolio or a new buyer looking for durable assets, understanding where to deploy capital in a recession is critical.

In this post, we’ll break down the top three commercial real estate sectors that offer resilience during downturns—industrial real estate, medical office buildings, and necessity-based retail. Each has its own strengths, challenges, and long-term outlook—but together, they represent a strong foundation for any investor looking to build a portfolio that can weather the next economic storm.

Let’s dive in.