There’s no way around it - being a small business owner is challenging.

Before selling late last year, I owned a small mechanical services business for a number of years. I know firsthand that there are nearly an infinite number of things that can keep you up at night, and that’s even when everything is going well!

With all of the day-to-day distractions, It is easy to see why real estate can take a back seat for business owners. Owners know it is important, but the decisions can be complicated and feel secondary to the actual operation of the business.

Many owners feel that buying a property is going to be a distraction, and won’t actually give their business an edge.

The Pros & Cons of Renting Commercial Space

There are certainly advantages to renting, particularly for new businesses.

First - you can keep more of your capital for startup expenses or working capital and second - you aren’t necessarily locked into a location long term. The latter part is a little more tricky in practice, as landlords may require longer term leases and personal guarantees. If you are going to lease space, be sure to have an experienced adviser in your corner.

One thing nearly all businesses can count on is that the rent will go up - but that doesn’t have to be the case.

Applying House Hacking to Commercial Real Estate

A concept that has caught fire in recent years on the residential side is “house hacking,” where an individual buys a house or small multifamily property to live in and rents the remaining rooms/units to tenants in order to reduce their monthly house payment, or potentially even turn a profit.

Though it isn’t as widely discussed a strategy, the same principle is true of commercial real estate - a business owner can effectively reduce their monthly payments by purchasing the building in which they reside.

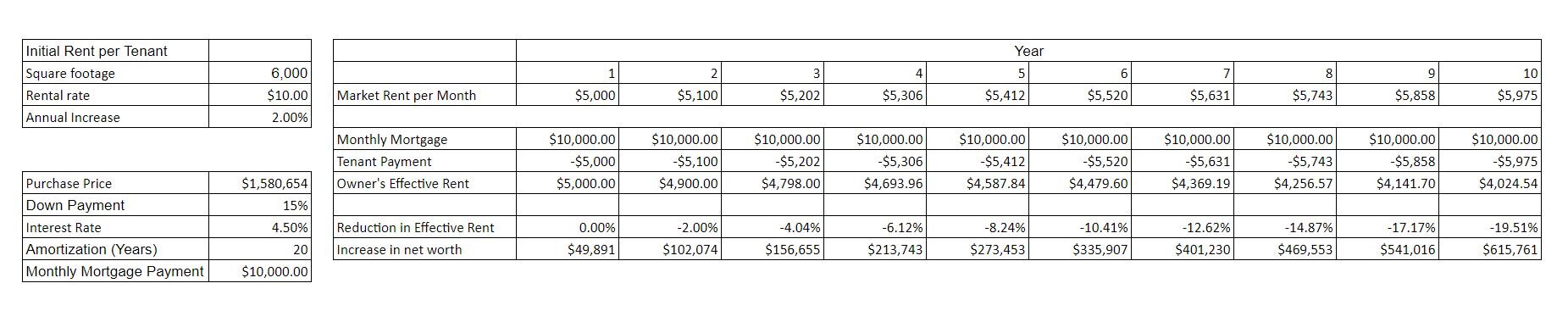

The data in the table provides an example of how this can be done for a sample business:

I have assumed the business in question needs 6,000 square feet and has purchased a 12,000 square foot building. The owner will occupy half the building and rent the remainder to another business that needs the same amount of space. The math will change as the ratio does (we’re at 50/50 utilization). For simplicity, I have assumed the leases are operating on a triple net basis, where all expenses, including repairs, insurance, taxes, and management fee are passed through to the tenants and apportioned based on the rented square footage.

In this scenario, the owner has purchased a $1.86m property with preferential owner-occupant fixed-rate financing terms that resulted in a mortgage payment of $10,000 per month. Because the current rate for similar space in the example is $10 per foot per year, the tenant’s monthly rent is $5,000. By subtracting the tenant’s $5,000 rental payment from the owner’s $10,000 monthly mortgage payment, the owner has an identical effective rental payment of $5,000.

There may be other reasons to own real estate (there are - more on that below!), but so far it looks like the owner parted with a down payment and ended up with a market rate rent, which by itself would be a bad deal. But as we said earlier, nearly all tenants expect the rent to increase and this is where it starts to get interesting for the owner.

Control of Your Destiny Isn’t The Only Benefit of Ownership…

If the tenant has 2% annual increases in the lease, which is fairly typical, the next year the tenant’s monthly rent is $5,100. Because the mortgage is fixed at $10,000 per month, the owner’s effective rent is now $4,900. Continuing at this rate, after 10 years, the tenant’s rent is $5,975 per month while the owner’s effective rent is $4,025. Not only did the owner avoid a 19.5% increase in market rents, they actually reduced their effective rent by 19.5% over the course of those 10 years.

Beyond saving the business owner operational dollars (rent) each year, the property has increased the owner’s equity by $615,000 over 10 years just by paying down the debt. That is beyond any potential price appreciation or tax benefits afforded to the owner.

And if you’re willing to get creative, you may be able to buy commercial real estate with no money down - infinite returns!

If you’re looking to buy or lease a new space for your business, give us a call. I’m happy to walk you through the options that make the most sense for your business.